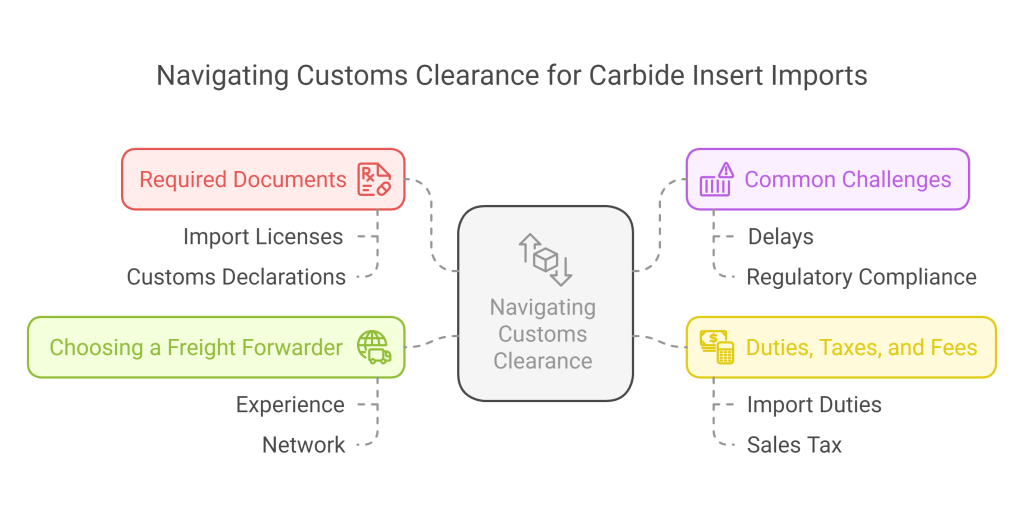

When importing carbide inserts, navigating customs clearance can be a complex process. Understanding the requirements and potential pitfalls can save time and costs.

Customs clearance for carbide inserts involves key documents, regulations, and tariffs that can vary by country. Getting it right the first time helps avoid unnecessary delays and costs.

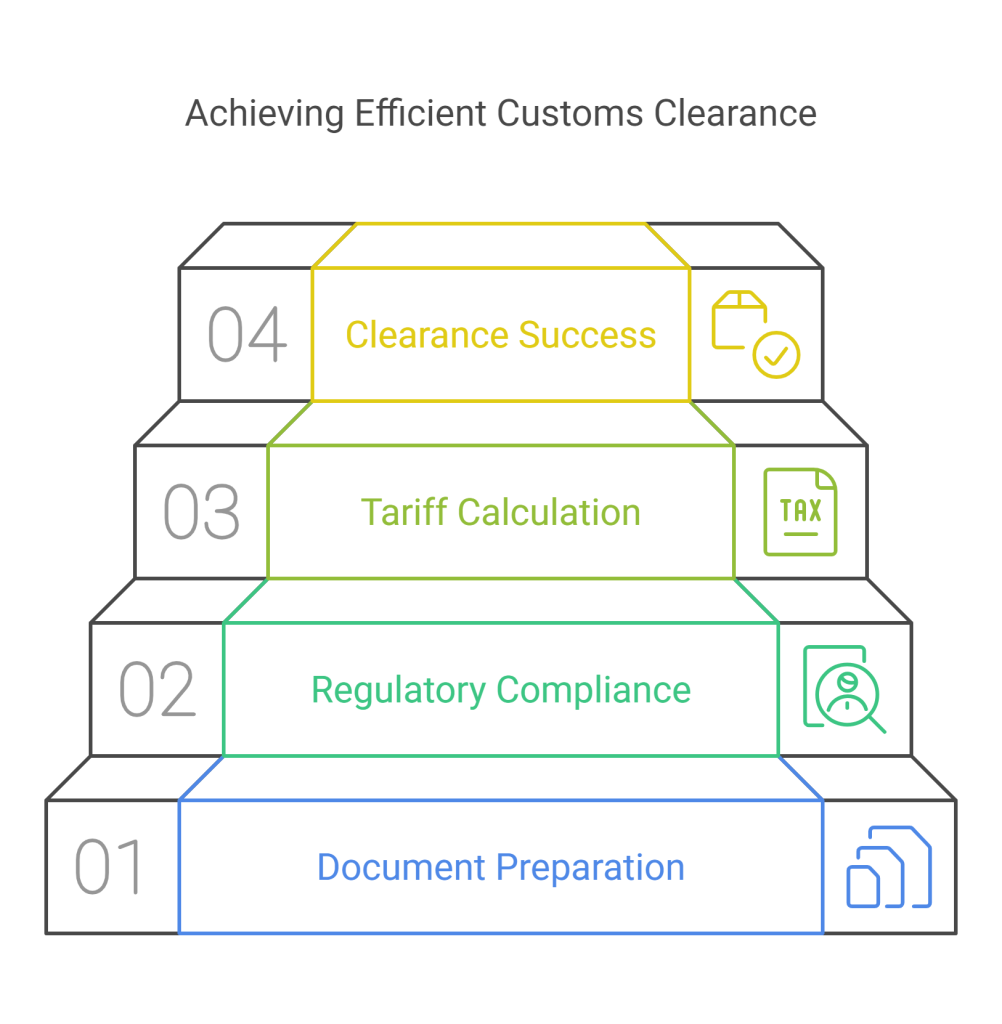

With so many steps involved, it’s important to break down the process into manageable steps to ensure smooth clearance. Let’s explore how you can navigate the complexities of customs clearance effectively.

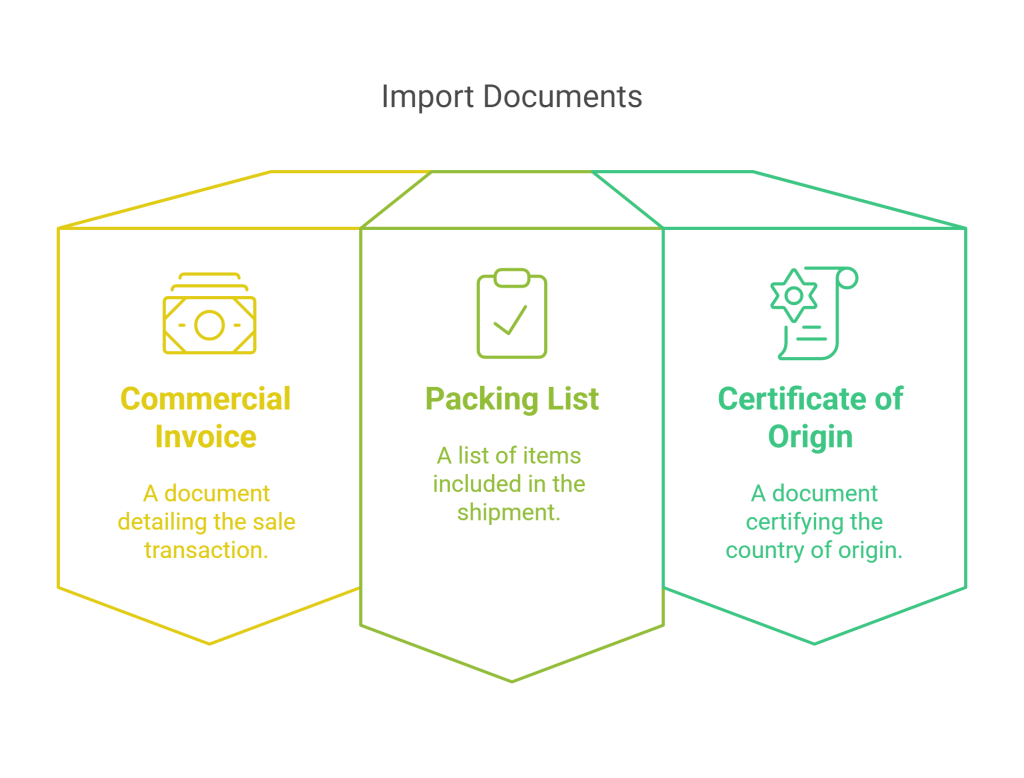

What Documents Are Required for Carbide Insert Imports?

One of the most important steps in customs clearance is preparing the right documentation. Mistakes or missing paperwork can lead to delays and extra charges.

For carbide insert imports, documents like the commercial invoice, packing list, and certificate of origin are essential for clearing customs. Be sure everything is correct before submission.

To avoid unnecessary delays, ensure you have the following key documents ready:

- Commercial Invoice: This document lists the value of the goods, which is necessary for calculating duties and taxes.

- Packing List: Specifies the contents of the shipment, which is vital for customs inspection.

- Certificate of Origin: Proves the origin of the goods, which can influence tariff rates depending on trade agreements.

- Bill of Lading: Serves as proof of shipment and is necessary for claiming the goods.

- Import Permit or Conformity Certificate: Some countries require these specific documents to ensure the product meets local standards.

According to the World Bank’s Doing Business report, the average time for customs clearance varies by region, ranging from 1 to 7 days. In the European Union, clearance typically takes around 3 days for industrial products, while in some Asian countries like China, it can take up to 5 days.

Inadequate documentation or errors can cause customs officers to hold your shipment for inspection or even fines, slowing down your delivery times and increasing costs.

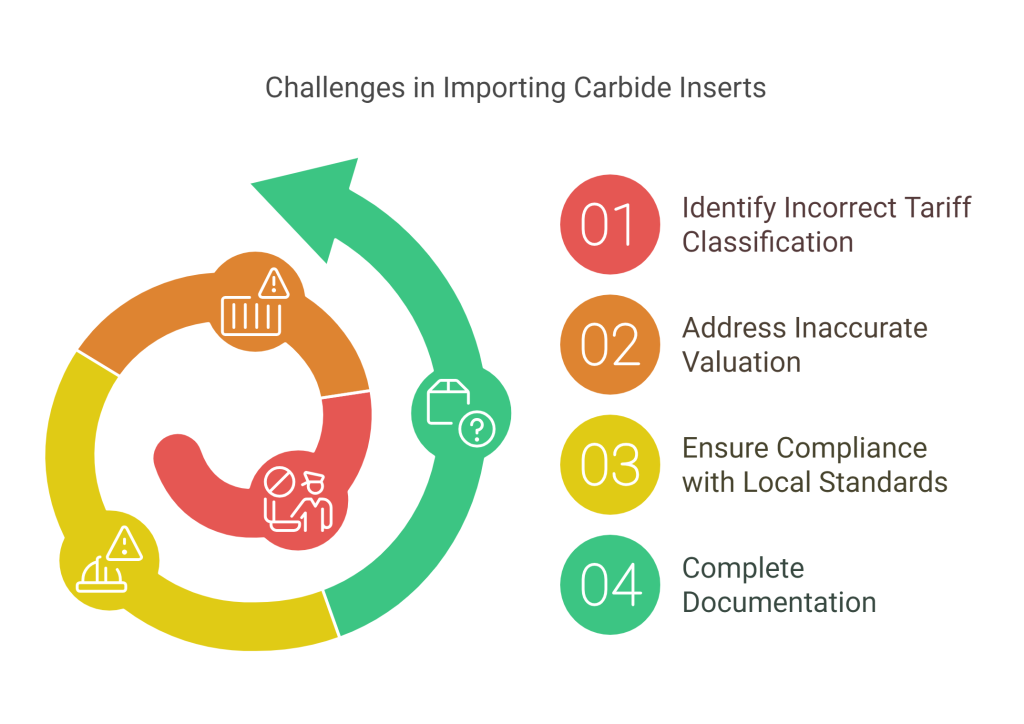

How to Avoid Common Challenges in Carbide Insert Customs Clearance?

Importing carbide inserts comes with a unique set of challenges, but understanding what these are can help you prepare and avoid them.

Customs clearance challenges for carbide inserts often stem from incorrect classifications or incomplete paperwork. Awareness of these issues can help streamline the process.

The most common challenges in importing carbide inserts typically arise from:

- Incorrect Tariff Classification: Carbide inserts fall under specific HS codes, and misclassifying them can result in penalties. Always double-check the correct HS code for your product.

- Inaccurate Valuation: If the customs value of the shipment is misreported, the shipment can be delayed or rejected. Be sure to declare the correct value and include all shipping costs.

- Failure to Meet Local Standards: Certain countries require certification proving the product meets local safety or quality standards. If your inserts don’t meet these regulations, they could be blocked from entry.

- Incomplete Documentation: Missing or incomplete documents, such as a lack of an import permit or a missing packing list, are frequent causes of delays.

A study by the International Trade Centre (ITC) shows that the average customs clearance delay due to misclassification or incomplete paperwork is about 2–3 days. This delay can cost businesses up to 5% of the total value of the shipment in extra fees and fines.

Addressing these challenges before they arise can prevent costly delays and fines and ensure a smooth clearance process.

What Are the Duties, Taxes, and Fees Involved in Carbide Insert Imports?

Another important aspect of customs clearance is understanding the various duties, taxes, and fees that apply to your carbide insert imports.

Duties and taxes vary depending on the country of import and the classification of your carbide inserts. It’s essential to know what fees apply to avoid surprises.

The amount of duties and taxes you’ll pay depends on various factors:

- Tariff Rates: These are set based on the HS code classification of carbide inserts. For example, imports into the EU or US may be subject to different rates.

- Country of Origin: Countries with trade agreements may offer reduced or zero tariff rates on imports from certain regions. For instance, a trade agreement between China and a country in the EU could lower import duties for carbide inserts from China.

- Customs Value: Taxes and duties are often calculated based on the customs value, which includes the price of the goods plus shipping and insurance.

- Additional Fees: Some countries charge additional fees for processing or inspection. These can include handling fees, inspection fees, or administrative fees that vary by country.

HS Code Details for Carbide Inserts:

- HS Code 8207: Cutting tools like carbide inserts used in metalworking processes.

- HS Code 8208: Tools for boring or turning, including carbide inserts.

Tariff Rates:

- USA: Carbide inserts under HS Code 8207 typically incur a tariff of 6%.

- EU: Carbide inserts may be subject to an average tariff of 4% under the same HS codes.

- China: Imported carbide inserts face a tariff of 7% on average.

- India: India applies a 10% import duty on carbide inserts under HS Code 8207.

Knowing the total costs involved in customs clearance can help you budget appropriately and avoid surprises upon arrival.

How to Choose the Right Freight Forwarder for Carbide Insert Imports?

leading paragraph:

Choosing the right freight forwarder is key to a successful import process. Their expertise in handling international shipments can make all the difference.

snippet paragraph:

A skilled freight forwarder can help ensure that your carbide inserts clear customs smoothly by providing proper documentation and managing logistics efficiently.

When selecting a freight forwarder, consider the following factors:

- Experience with Similar Products: Choose a forwarder experienced with industrial products like carbide inserts. Their familiarity with your product type ensures they know what documents are necessary and how to handle the logistics.

- Customs Knowledge: A good freight forwarder should have in-depth knowledge of the import regulations and customs procedures in your destination country.

- Global Network: A well-connected freight forwarder can help you navigate different customs systems and provide timely solutions if issues arise.

- Reputation: Look for reviews and testimonials to ensure the forwarder has a solid track record of reliable service.

According to a survey by the International Federation of Freight Forwarders Associations (FIATA), 35% of international shipments face delays due to improper documentation. Freight forwarders that specialize in industrial goods can significantly reduce these delays by ensuring compliance with all customs regulations.

A good freight forwarder will minimize delays, ensure compliance with regulations, and ultimately save you time and money.

Conclusion

Successfully navigating customs clearance for carbide inserts requires thorough preparation and knowledge. By understanding the necessary documents, fees, and challenges, you can ensure smooth and cost-effective imports.